Create efficient digital experiences with Low-Code

Drive the digital transformation of your financial company with low-code solutions. Improve the performance of your employees and increase time-to-market with smart applications.

Optimize your customer onboarding

Manage everything digitally! Completely eliminate physical paperwork and improve your customers' experience avoiding all kinds of frictions. Manage data, portfolios and documentation more effectively to avoid user dissatisfaction.

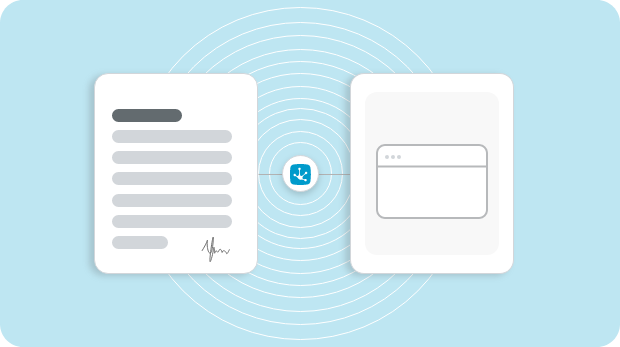

See what matters in one place

Get a single, comprehensive view of company results in one place. Maintain full control of the business through graph-based dashboards, charts and visuals that allow you to manage operations much more simply. Discover new opportunities!

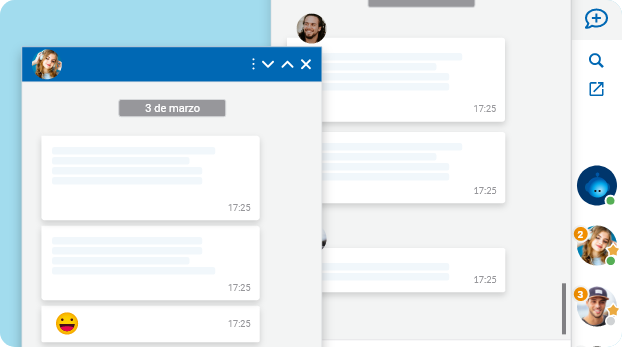

Increase collaboration between workgroups

Collaboration is key to increasing productivity in a work team. Deyel has collaboration tools where business specialists can interact through messaging, sharing information, status, comments and specific documentation. This social messaging allows all communication between sender and receiver to be associated to the case as part of its execution and resolution, becoming a fundamental part of the process.