Streamline your customer lifecycle processes

Enable end users to create service requests, upload documents and review the status of open items. From opening an account to managing credit applications to resolving issues, every customer interaction is an opportunity to build trust and loyalty. A low-code platform like Deyel enables banks to automate and optimize these critical processes, ensuring that every step of the customer lifecycle is smooth, efficient and frictionless.

Seamless integration into existing systems

Thanks to Deyel's integration capabilities, you can easily integrate with your company's Legacy systems and develop applications that allow you to improve the experience of both your customers and employees.

Automate the loan process from start to finish!

Full automation of the loan process involves customers initiating and completing the entire process digitally, from application to signing contracts and receiving funds. This approach reduces loan approval time, increases transparency and creates convenience for the client, who can track their application in real time, receiving automatic updates at every stage of the process.

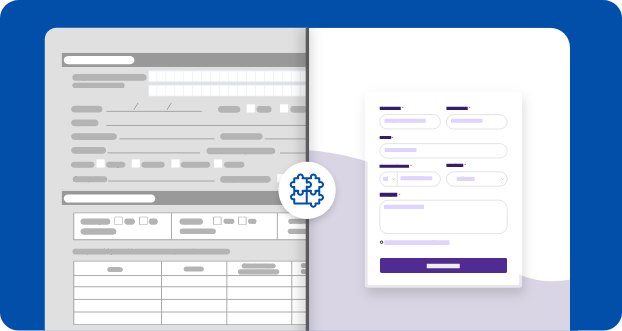

See what's important in one place

Analyze data simply and control every detail of the business with visually appealing dashboards containing easy-to-read management indicators.

Dashboards not only centralize information, but also transform complex data into clear and understandable visualizations. This makes it easy to identify trends, patterns and areas for improvement in real time.

Get scalable applications that adapt to new needs

Get applications that can support a higher volume of users or expand into new markets.

Scalable application development meets immediate needs and also prepares your business for the future. These applications are built with a flexible architecture that allows for the addition of new functionality as your organization's needs change. Whether you decide to launch new products, enhance existing services or explore new opportunities.